Building Solana Trading Bots: Arbitrage and DeFi Strategies (2026)

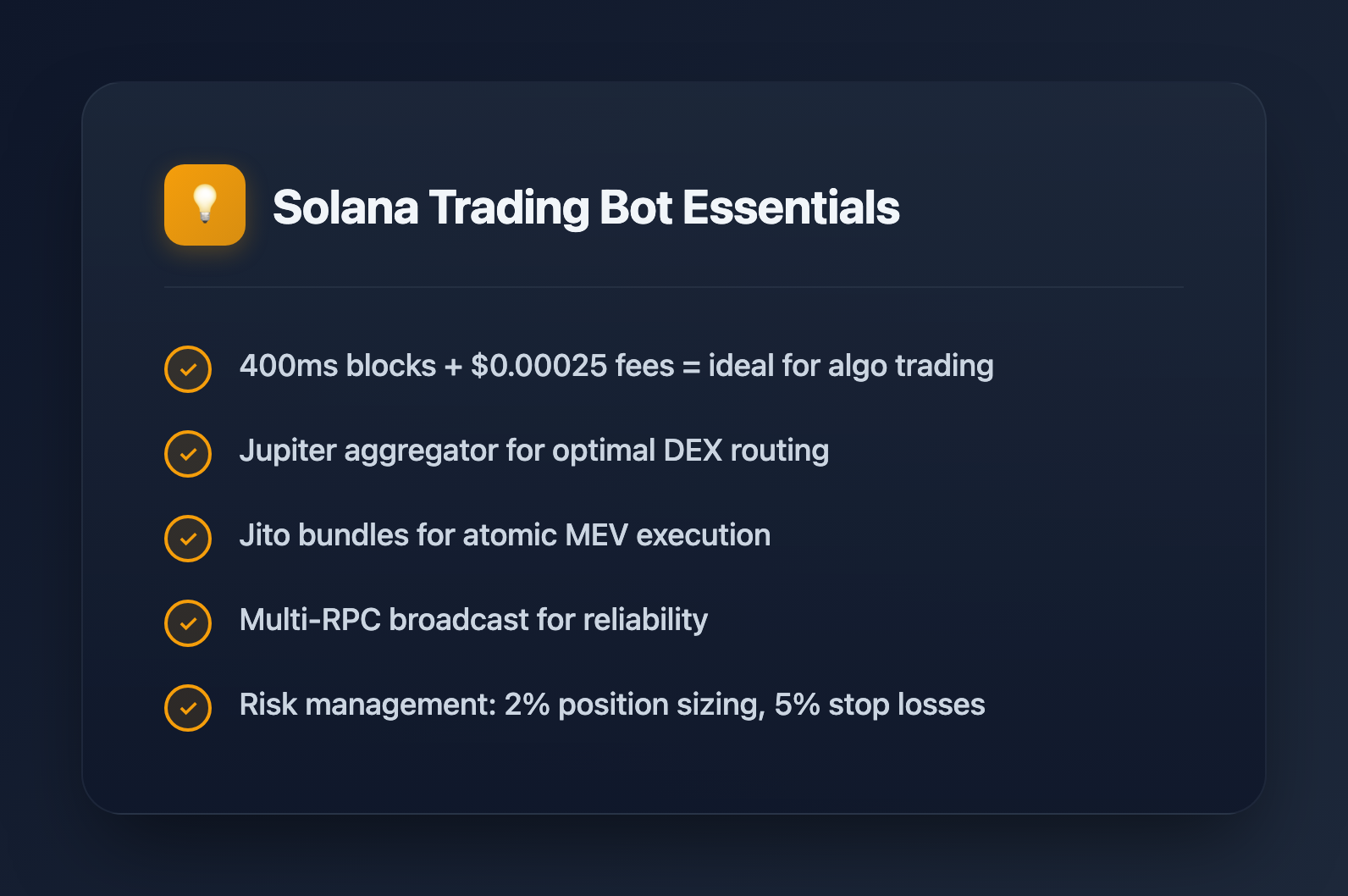

Solana's sub-second block times and low fees make it the premier blockchain for automated trading. This guide covers everything from basic bot architecture to advanced MEV strategies.

Why Solana for Trading Bots?

Solana offers unique advantages for algorithmic trading:

| Feature | Solana | Ethereum |

|---|---|---|

| Block time | ~400ms | ~12s |

| Transaction cost | ~$0.00025 | $1-100+ |

| Throughput | 65,000 TPS | ~30 TPS |

| Finality | ~400ms | ~15 min |

These characteristics enable strategies impossible on slower chains.

Bot Architecture Fundamentals

Every successful Solana trading bot needs:

1. Fast RPC Connection

import { Connection } from "@solana/web3.js";

// Public RPC - fine for testing

const connection = new Connection("https://api.mainnet-beta.solana.com");

// Production - use dedicated providers

const connection = new Connection("https://your-helius-url.helius-rpc.com");For competitive trading, consider:

- Helius: Best for general use, good websocket support

- QuickNode: Enterprise-grade, Geyser plugins

- Triton: Validator co-location for minimum latency

2. Wallet Management

import { Keypair } from "@solana/web3.js";

import bs58 from "bs58";

// Load from environment

const privateKey = process.env.PRIVATE_KEY;

const keypair = Keypair.fromSecretKey(bs58.decode(privateKey));Security: Never commit private keys. Use environment variables or secure vaults.

3. Transaction Submission

import {

Transaction,

sendAndConfirmTransaction,

ComputeBudgetProgram

} from "@solana/web3.js";

// Add priority fee for congested periods

const priorityFee = ComputeBudgetProgram.setComputeUnitPrice({

microLamports: 50000 // Adjust based on network conditions

});

const transaction = new Transaction()

.add(priorityFee)

.add(yourInstruction);

const signature = await sendAndConfirmTransaction(

connection,

transaction,

[keypair]

);Arbitrage Strategies

DEX Arbitrage

Solana's DEX ecosystem includes Raydium, Orca, Jupiter, and Meteora. Price discrepancies between them create arbitrage opportunities.

import { Jupiter } from "@jup-ag/core";

const jupiter = await Jupiter.load({

connection,

cluster: "mainnet-beta",

user: keypair.publicKey,

});

// Get routes for a swap

const routes = await jupiter.computeRoutes({

inputMint: USDC_MINT,

outputMint: SOL_MINT,

amount: 1000 * 1e6, // 1000 USDC

slippageBps: 50,

});

// Find profitable round-trip

const bestBuy = routes.routesInfos[0];

const reverseRoutes = await jupiter.computeRoutes({

inputMint: SOL_MINT,

outputMint: USDC_MINT,

amount: bestBuy.outAmount,

slippageBps: 50,

});

const profit = reverseRoutes.routesInfos[0].outAmount - 1000 * 1e6;

if (profit > MIN_PROFIT_THRESHOLD) {

// Execute arbitrage

}Triangular Arbitrage

Exploit price inefficiencies across three tokens:

USDC -> SOL -> RAY -> USDCIf the final USDC amount exceeds the initial amount plus fees, you profit.

Cross-DEX Arbitrage

Buy on one DEX, sell on another:

async function findCrossDexArbitrage(tokenMint: PublicKey) {

const [raydiumPrice, orcaPrice] = await Promise.all([

getRaydiumPrice(tokenMint),

getOrcaPrice(tokenMint),

]);

const spread = Math.abs(raydiumPrice - orcaPrice) / raydiumPrice;

if (spread > 0.005) { // 0.5% spread

return {

buyDex: raydiumPrice < orcaPrice ? "raydium" : "orca",

sellDex: raydiumPrice < orcaPrice ? "orca" : "raydium",

spread,

};

}

return null;

}MEV and Jito Integration

Maximal Extractable Value (MEV) on Solana primarily works through Jito:

import { searcherClient } from "jito-ts/dist/sdk/block-engine/searcher";

const client = searcherClient(

"https://mainnet.block-engine.jito.wtf",

keypair

);

// Create a bundle (atomic transaction group)

const bundle = [

transaction1, // Your arbitrage buy

transaction2, // Your arbitrage sell

];

// Submit with tip

await client.sendBundle(bundle, {

tipLamports: 10000, // Tip to validator

});Bundle benefits:

- Atomic execution (all or nothing)

- Front-running protection

- Priority access to block space

Token Sniping

Monitor for new token listings and buy early:

connection.onLogs(

RAYDIUM_PROGRAM_ID,

async (logs) => {

if (logs.logs.some(log => log.includes("InitializeInstruction"))) {

// New pool detected

const poolInfo = await parseNewPool(logs);

// Execute snipe with safety checks

if (await passesRiskCheck(poolInfo)) {

await executeBuy(poolInfo, SNIPE_AMOUNT);

}

}

},

"confirmed"

);Warning: Sniping is high-risk. Many new tokens are scams or rug pulls. Implement strict risk management.

Risk Management

Position Sizing

const MAX_POSITION_PERCENT = 0.02; // 2% of portfolio per trade

const MAX_DAILY_LOSS = 0.05; // 5% daily loss limit

function calculatePositionSize(portfolioValue: number, riskScore: number) {

const baseSize = portfolioValue * MAX_POSITION_PERCENT;

return baseSize * (1 - riskScore); // Reduce size for riskier trades

}Stop Losses

async function monitorPosition(token: PublicKey, entryPrice: number) {

const STOP_LOSS = 0.05; // 5% stop loss

const interval = setInterval(async () => {

const currentPrice = await getPrice(token);

const loss = (entryPrice - currentPrice) / entryPrice;

if (loss > STOP_LOSS) {

await executeSell(token);

clearInterval(interval);

}

}, 1000); // Check every second

}Gas Management

async function getDynamicPriorityFee(): Promise<number> {

const recentFees = await connection.getRecentPrioritizationFees();

const avgFee = recentFees.reduce((a, b) => a + b.prioritizationFee, 0)

/ recentFees.length;

// Pay slightly above average for reliability

return Math.ceil(avgFee * 1.2);

}Infrastructure Considerations

Latency Optimization

- Co-location: Run your bot near Solana validators

- Multiple RPCs: Broadcast to multiple endpoints

- Geyser plugins: Direct slot updates without polling

// Multi-RPC broadcast

async function broadcastTransaction(tx: Transaction) {

const rpcs = [

"https://rpc1.example.com",

"https://rpc2.example.com",

"https://rpc3.example.com",

];

await Promise.all(

rpcs.map(rpc => {

const conn = new Connection(rpc);

return conn.sendRawTransaction(tx.serialize(), {

skipPreflight: true,

maxRetries: 0,

});

})

);

}Error Handling

async function executeWithRetry(

fn: () => Promise<string>,

maxRetries = 3

): Promise<string | null> {

for (let i = 0; i < maxRetries; i++) {

try {

return await fn();

} catch (error) {

if (error.message.includes("blockhash not found")) {

// Retry with new blockhash

continue;

}

if (error.message.includes("insufficient funds")) {

// Don't retry - actual problem

throw error;

}

await sleep(100 * Math.pow(2, i)); // Exponential backoff

}

}

return null;

}Regulatory Considerations

Important: Automated trading may be subject to regulations depending on your jurisdiction. Consider:

- Securities laws if trading tokens that might be securities

- Tax obligations on trading profits

- AML/KYC requirements for larger operations

Consult legal counsel before deploying significant capital.

Related Resources

New to Solana development? Start with our Solana JavaScript Guide covering @solana/web3.js fundamentals.

Preparing for blockchain roles? Check our Solana Interview Questions for technical preparation.

Conclusion

Building profitable Solana trading bots requires:

- Fast infrastructure: Dedicated RPCs, low-latency hosting

- Smart strategies: Arbitrage, MEV, or sniping with edge

- Risk management: Position sizing, stop losses, diversification

- Continuous improvement: Monitor performance, adapt to market

Start small, test thoroughly on devnet, and scale gradually as you validate your strategies.